"Real estate investing, even on a very small scale, remains a tried and true means of building an individual’s cash flow and wealth." Robert Kiyosaki, Author of Rich Dad, Poor Dad.

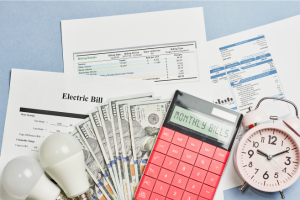

Perhaps the most significant metric for rental property is “cash flow”. Cash flow is the net income after deducting all expenses, which includes utilities (i.e. water, electricity, sewer) and property insurance.

A real estate investor recently asked a great question regarding the customs in New Jersey for whether the landlord or tenant is responsible for payment of utilities and insurance.

Let’s break it down in this post.

Who Pays for Utilities?

In New Jersey, utilities are negotiable between the landlord and tenant as part of the lease negotiations.

Landlords prefer tenants to pay utilities because:

- Reduced Landlord Expenses: Leases requiring tenants to pay for utilities directly improves the landlord’s cash flow.

- Encourages Efficiency: Tenants will not be financially motivated to be reasonable with utility usage if there is no cost to them.

- Simple Accounting: Eliminates the need for the landlord to calculate, manage, and bill utility costs separately.

- Predictable Cash Flow: Landlords can better predict their rental profitability by removing the fluctuating costs of utilities.

- Avoids Conflict: Landlords paying utilities will have a tenant dispute if tenant is overusing utilities.

- Easier Property Management: Dealing with tenants is more straightforward if tenants managing their own utility.

Tenants are normally responsible for paying utilities if their unit is equipped with separate meters for the utility. A tenant would be expected to pay for utilities in: (1) a single-family property; or (2) a multi-family property where their specific unit can have a bill associated with it that utility.

Here is a standard lease provision requiring tenant to pay utilities:

UTILITIES AND SERVICES. Tenant shall be responsible for paying the following utility services: gas, electricity, cable, internet, and phone. Tenant shall arrange to have the utilities it is responsible for paying transferred to its name upon occupancy. For utilities Tenant is responsible to pay directly, Tenant agrees to promptly pay all bills and charges for utilities and services furnished to the Premises.

The situation is more complicated it is a multi-family building with no separate meters (i.e. there is no way to directly bill one of the tenants).

In this scenario, landlords commonly divide utility costs based on the square footage of the unit, historical estimated usage for each unit, or another reasonable allocation method outlined in the lease agreement. A clause requiring a tenant to pay a portion of utilities based on square footage might read:

UTILITIES AND SERVICES. Tenant shall pay for the following utility services for the Apartment: cable, electric, gas, internet, landline phone, and 82% of water bill for the entire Premises. Water will be billed to Tenant by the Landlord. With the exception of the water bill, Tenant shall have the utilities it is responsible for paying transferred or kept to its name unless Landlord determines that the utility should be in the Landlord’s name.

Who Pays for Insurance?

Property damage insurance in New Jersey residential leases is virtually always paid for by landlords. Landlords obtain a specific policy called “landlord’s insurance policy” to ensure coverage over rental property. Landlord’s insurance covers the physical structure.

However, landlords should require tenants to obtain renter’s insurance. Renter’s insurance is affordable and protect the tenant’s personal belongings while offering some liability coverage in case of accidents.

A standard clause requiring tenants to maintain rental insurance is as follows:

INSURANCE ON TENANT BELONGINGS: Landlord carries no insurance covering loss to any of Tenant’s belongings, whether located or stored inside or outside the Apartment. Tenant has total responsibility for securing insurance protection against loss by fire or other cause to Tenant’s belongings. Tenant shall obtain, at Tenant’s own cost and expense, a tenant’s insurance policy for Tenant’s furniture, furnishings, clothing and other personal property on the Premises. Tenant shall periodically furnish Landlord with evidence of Tenant’s insurance policy upon request.

Conclusion

To summarize, in New Jersey, tenants typically pay for utilities in single-family homes or multi-family homes with separate meters, while landlords bear the cost of property insurance.

However, landlords should require your tenant to carry renter’s insurance to protect their belongings.

Stay ahead with our free newsletter: The Real Estate Law Newsletter – your source for real estate law news.

Essential updates and insights direct to you. Impress clients and colleagues with trending news. Sharpen expertise. Stay legally compliant. Access free legal forms. Don’t miss out – join today!