Are you seeking to change a real estate deed with an open mortgage in New Jersey?

Owners can transfer title to real estate with an open mortgage but unless exceptions under the Garn–St. Germain Depository Institutions Act apply this transfer risks the lender exercising the “due on sale clause” demanding payment of the full loan balance. Transferring ownership of the real estate will not however automatically change the party responsible to pay the mortgage.

This guide is for New Jersey homeowners, families planning transfers, executors handling estates, and divorcing spouses. It explains what’s legally allowed, what can go wrong, and how to complete a deed transfer properly while understanding the lender’s rights.

Call our law firm today at (201) 627-2457 or use the contact form for assistance with real estate deeds.

Can you transfer ownership of a real estate with an open mortgage?

New Jersey property can be conveyed by a deed even if there is an open mortgage recorded against it. The mortgage remains a lien on the property until it is paid off and discharged. The person responsible to pay the mortgage remains responsible under the mortgage and promissory note unless a separate agreement was reached with the mortgage holder.

The due-on-sale clause: why deed transfers can create lender risk

Most conventional residential mortgages include a due-on-sale clause which allows the lender to declare the loan immediately due if the property (or an interest in it) is transferred without the lender’s consent.

For example, the standard Fannie Mae uniform mortgage provides that if the property or any interest in it is transferred without the lender’s prior written consent, the lender may require immediate payment in full of the loan balance, unless prohibited by applicable law. See Fannie Mae Form 3031 (“If all or any part of the Property or any Interest in the Property is sold or transferred . . . without Lender’s prior written consent, Lender may require immediate payment in full of all sums secured by this Security Instrument. However, Lender will not exercise this option if such exercise is prohibited by Applicable Law.”)

However, the federal statute Garn–St. Germain Depository Institutions Act (12 U.S.C. § 1701j-3(d)) declares that some transfers are protected from enforcement of a due on sale clause, including:

- to a relative resulting from the borrower’s death,

- where the borrower’s spouse or children become owners,

- arising from divorce or legal separation where a spouse becomes an owner, and

- into certain inter vivos (living) trusts where the borrower remains a beneficiary and occupant.

These protections limit a lender’s ability to accelerate the loan solely because of the transfer, but they do not eliminate the borrower’s obligation to continue making payments or complying with the loan terms.

“Subject to” vs. “Assumption” of the Mortgage

In New Jersey, simply taking title to property encumbered by a mortgage does not automatically make the new owner personally liable for the mortgage debt. New Jersey requires an express assumption agreement in writing, or an assumption covenant in the deed, before the grantee is deemed to have assumed the mortgage debt.

See N.J.S.A. 46:9-7.1. (“Whenever real estate . . . is at the time of any such sale or conveyance subject to an existing mortgage, the purchaser shall not be deemed to have assumed the debt . . . unless the purchaser shall have assumed such mortgage debt . . .by an express agreement in writing signed by the purchaser or . . . acceptance of a deed containing a covenant . . . that the grantee assumes such mortgage debt.”)

Risk for Both Sides of a Deed-Only Transfer

Even though the new owner may not be personally liable on the note, the mortgage lien still burdens the property. If payments stop, the lender can foreclose on the property, and the new owner can lose it.

At the same time, the original borrower remains on the hook to the lender. Their credit can be damaged by late payments or default, even after they no longer own the property. This is the core danger of transferring ownership while leaving the mortgage in the prior owner’s name.

On the other side, the new owner can be trapped in a fragile arrangement: they own the house, but they rely on someone else to keep paying a loan tied to someone else’s credit. That structure often collapses during disputes, job loss, remarriage, or family conflict.

How to transfer ownership of a Property with an Open Mortgage

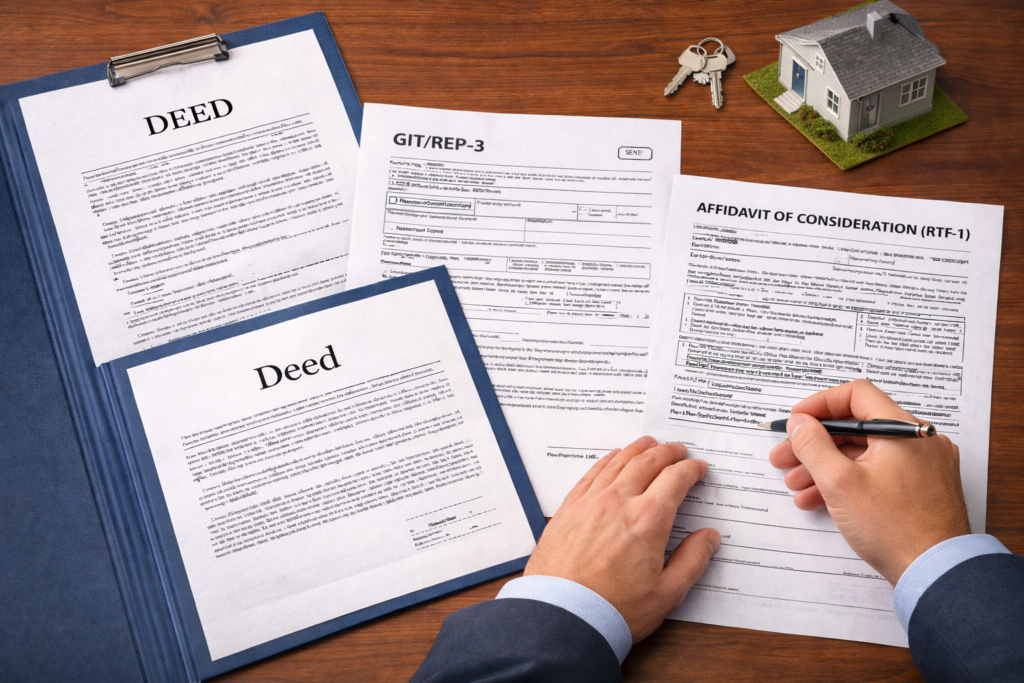

Transferring real estate with an open mortgage in New Jersey is procedurally similar to other real estate conveyances. A deed and required tax forms must be prepared, including the GIT/REP certification and RTF-1 affidavit. The deed must be notarized and all forms completed consistently. The documents are then recorded with the county once all required recording fees are paid.

Step 1: Hire an Attorney

In New Jersey, preparation of a deed is considered the practice of law. While a person may draft for themselves, an attorney is required to draft a deed for others and will help reduce mistakes and avoid rejected recordings.

An attorney helps you:

- select the correct deed form (warranty, special warranty, or quitclaim),

- ensure the legal description is correct,

- confirm how title is held and whether all owners must sign,

- assess due-on-sale risk and whether the transfer likely fits a federal exception, and

- coordinate with your lender if communication is appropriate.

This is especially important when the plan involves a deed transfer but no immediate assumption or refinancing.

Step 2: Prepare Required Documents

Deed. A deed is a written legal document that formally transfers ownership of real estate from one party to another.

A deed must clearly identify the grantor and grantee, showing who is transferring ownership and who is receiving it. It must include an accurate legal description of the property and language that clearly states the intent to convey title, along with the type of deed being used.

GIT/REP Form. The GIT/REP-3 is a certification used in real estate transfers to determine whether state gross income tax withholding is required. It includes information about the transferor’s residency status, the nature of the transfer, and any claimed exemption so the county can accept the deed for recording.

Affidavit of Consideration (RTF) The RTF-1 (Affidavit of Consideration for Use by Seller) is used to determine whether the Realty Transfer Fee applies to a real estate transfer and, if so, how much is owed. It includes information such as the parties to the transfer, the property location, the type of deed, the amount and type of consideration involved (including whether the property is transferred subject to an existing mortgage), and any statutory exemption, such as transfers between family members, incident to divorce, or estate administration.

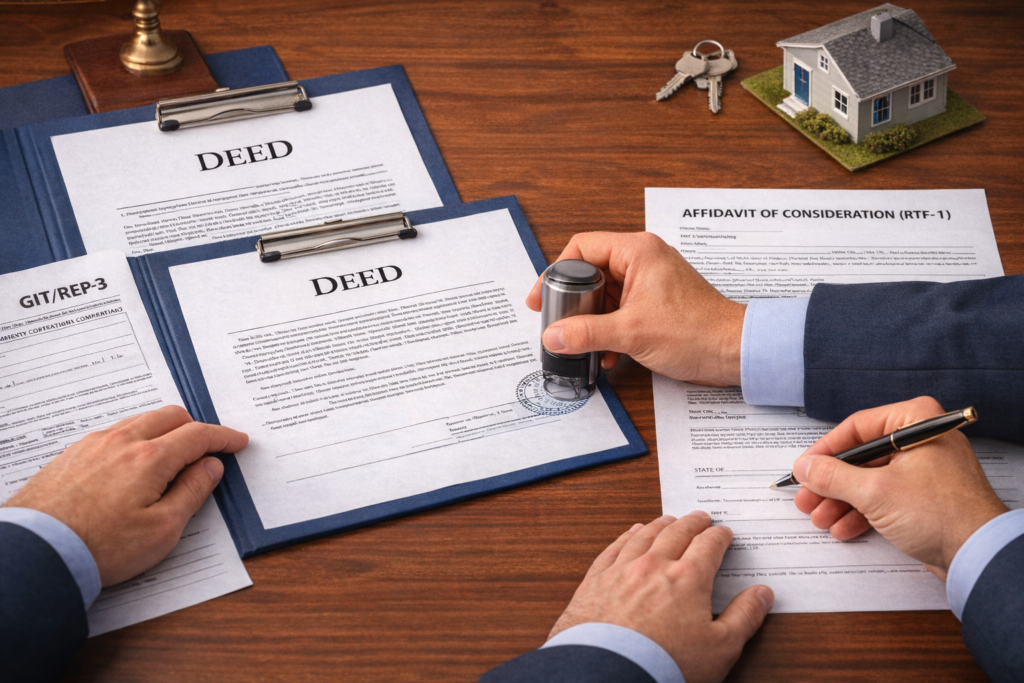

Step 3: Execute the Documents

Once the paperwork is prepared, the documents must be executed correctly to be legally effective and accepted for recording. The deed must be signed by the grantor and properly acknowledged before a notary public, with the notarial certificate completed in compliance with New Jersey recording requirements; even minor defects in signatures, dates, or notary language can cause the county clerk to reject the filing.

Supporting tax forms, including the GIT/REP-3 and RTF-1, must be filled out completely and in a manner that is consistent with the deed’s terms, such as the parties, consideration, and transfer type.

Step 4: Record the Documents

After execution, the documents must be submitted for recording in the county clerk’s office where the property is located. Recording makes the transfer part of the public land records and establishes priority against later liens, judgments, or competing ownership claims.

New Jersey counties permit electronic recording (e-recording), which is faster, provides immediate confirmation of receipt, and allows tracking of acceptance or rejection in real time. While paper recording is still allowed in many cases, it is typically slower and more susceptible to rejection cycles caused by minor clerical issues, incomplete forms, or payment errors.

Does the Realty Transfer Fee apply?

Whether the New Jersey Realty Transfer Fee (RTF) applies depends on the type of transfer, the consideration involved, and whether a statutory exemption is available. The fee is not limited to cash paid at closing; consideration includes the amount of an open mortgage. As such, unless an exception applies, Realty Transfer Fee must be paid on the balance of the open mortgage.

Deed transfers involving an open mortgage may qualify for full or partial exemptions, such as transfers incident to divorce, transfers between spouses, transfers for less than $100.00, parent-to-child transfers, or transfers made as part of estate or probate administration.

Frequently Asked Questions

1. Can you transfer ownership of a real estate with a mortgage without refinancing?

Ownership can be transferred without refinancing and the existing mortgage lien will continue to encumber the property after the deed is recorded. However, transferring title alone does not change who is legally responsible for the loan, and the original borrower remains liable unless the lender approves an assumption or release.

2. Can you transfer ownership of a real estate with a mortgage after death?

Ownership of real estate can be transferred after the death of a borrower even when a mortgage remains on the property, and this commonly occurs through probate proceedings, survivorship rights, or estate planning instruments such as wills or trusts. Federal law limits a lender’s ability to enforce a due-on-sale clause solely because of the death-related transfer, including transfers to relatives who inherit the property. However, while the lender may be prohibited from accelerating the loan due to the transfer itself, the mortgage does not disappear, and the heirs or beneficiaries must continue making payments to avoid foreclosure.

3. Can you transfer the mortgage to another person without refinancing?

Sometimes, but only if the mortgage is assumable and the lender approves the transfer through a formal assumption process. Transferring the mortgage does not involve recording a deed; instead, the lender requires the proposed borrower to apply, provide financial documentation, and meet credit and income standards under the loan’s guidelines. Even when allowed, the lender may not release the original borrower from liability, meaning they can remain responsible if the new borrower defaults, since assumptions are governed by lender approval and written authorization, not county recording rules.

Contact the Law Firm of Earl P. White

Contact us today for help with your real estate matter. We provide practical advice, responsive service, and clear direction to address the issue efficiently and protect your interests.

📞 Call Us: (201) 627-2457

💬 Send a Message: Use our contact form.

We look forward to assisting you with your real estate needs.